finlab.analysis

finlab.analysis.liquidityAnalysis.LiquidityAnalysis

Bases: Analysis

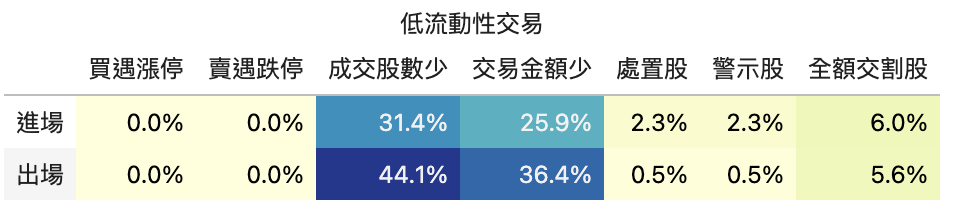

分析台股策略流動性風險項目的機率

Note

參考VIP限定文章更了解流動性檢測內容細節。

Args: required_volume (int): 要求進出場時的單日成交股數至少要多少? required_turnover (int): 要求進出場時的單日成交金額至少要多少元?避免成交股數夠,但因低價股因素,造成胃納量仍無法符合資金需求。

Examples:

# better syntax

report.run_analysis('LiquidityAnalysis', required_volume=100000)

# original syntax

from finlab.analysis.liquidityAnalysis import LiquidityAnalysis

report.run_analysis(LiquidityAnalysis(required_volume=100000))

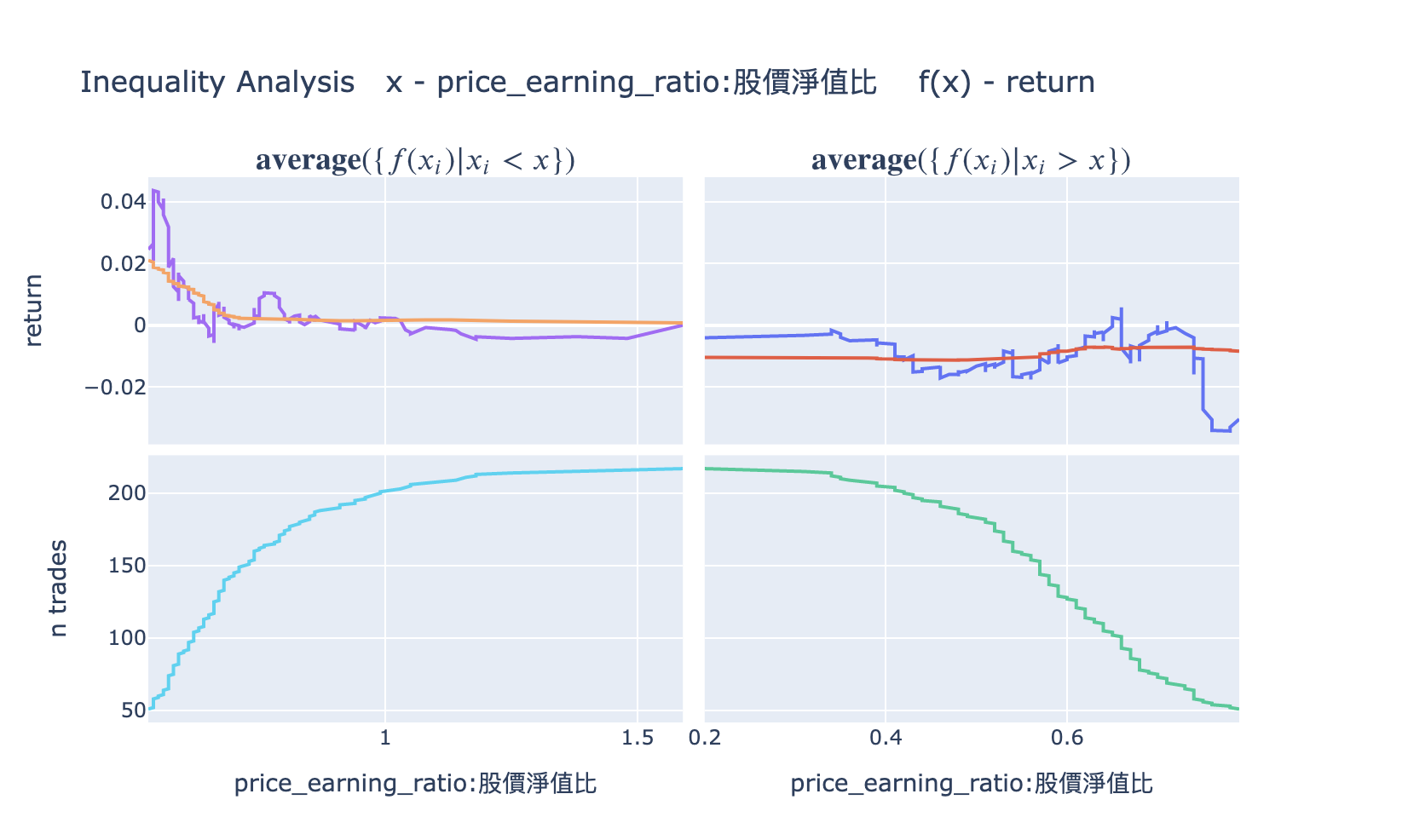

finlab.analysis.inequalityAnalysis.InequalityAnalysis

Bases: Analysis

Analyze return of trades with condition inequality

| PARAMETER | DESCRIPTION |

|---|---|

name |

name of the condition

TYPE:

|

df |

value used in condition. If df is None,

TYPE:

|

date_type |

can be either

TYPE:

|

target |

the target to optimize. Any column name in report.get_trades()

TYPE:

|

Examples:

finlab.analysis.periodStatsAnalysis.PeriodStatsAnalysis

Bases: Analysis

分析台股策略的不同時期與大盤指標作比較

Examples:

可以執行以下程式碼來產生分析結果:

產生的結果:

| benchmark | strategy | |

|---|---|---|

| ('overall_daily', 'calmar_ratio') | 0.149192 | 0.0655645 |

| ('overall_daily', 'sortino_ratio') | 0.677986 | 0.447837 |

| ('overall_daily', 'sharpe_ratio') | 0.532014 | 0.306351 |

| ('overall_daily', 'profit_factor') | 1.20022 | 1.07741 |

| ('overall_daily', 'tail_ratio') | 0.914881 | 0.987751 |

| ('overall_daily', 'return') | 0.0835801 | 0.0478957 |

| ('overall_daily', 'volatility') | 0.182167 | 0.312543 |

| ('overall_monthly', 'calmar_ratio') | 0.155321 | 0.0731378 |

| ('overall_monthly', 'sortino_ratio') | 0.697382 | 0.439003 |

| ('overall_monthly', 'sharpe_ratio') | 0.524943 | 0.307292 |

| ('overall_monthly', 'profit_factor') | 1.75714 | 1.27059 |

| ('overall_monthly', 'tail_ratio') | 1.03322 | 0.903335 |

| ('overall_monthly', 'return') | 0.0836545 | 0.0479377 |

| ('overall_monthly', 'volatility') | 0.186989 | 0.316178 |

| ('overall_yearly', 'calmar_ratio') | 0.436075 | 0.127784 |

| ('overall_yearly', 'sortino_ratio') | 0.738327 | 0.694786 |

| ('overall_yearly', 'sharpe_ratio') | 0.407324 | 0.350986 |

| ('overall_yearly', 'profit_factor') | 2.2 | 1.66667 |

| ('overall_yearly', 'tail_ratio') | 1.71647 | 1.359 |

| ('overall_yearly', 'return') | 0.0814469 | 0.0663674 |

| ('overall_yearly', 'volatility') | 0.284742 | 0.419087 |

假如希望開發交易分析系統,可以繼承 finlab.analysis.Analysis 來實做分析。

finlab.analysis.Analysis

Bases: ABC

analyze

Analyze trading report.

One could assume self.caluclate_trade_info will be executed before self.analyze,

so the report.get_trades() will contain the required trade info.

calculate_trade_info

Additional trade info can be calculated easily.

User could override this function if additional trade info is required for later anlaysis.

Examples:

from finlab.analysis import Analysis

class SomeAnalysis(Analysis):

def calculate_trade_info(self, report):

return [

['股價淨值比', data.get('price_earning_ratio:股價淨值比'), 'entry_sig_date']

]

report.run_analysis(SomeAnalysis())

trades = report.get_trades()

assert '股價淨值比@entry_sig_date' in trades.columns

print(trades)

display

Display result

When implement this function, returning Plotly figure instance is recommended.